Business Energy Comparison

Keep your business energy bills as low as possible

It’s easy to compare the latest business energy prices. Find a cheaper deal and switch online today!

We Work With Trusted UK Business Energy Suppliers

How to Get Our Best Business Energy Deal

-

1

Tell us your postcode and we'll find your meter

-

2

Compare our best deals from top suppliers

-

3

Choose a deal, we'll take care of the rest

Business Energy Comparison Made Simple

Saving money on your business energy bills is easier than putting the kettle on. Prefer to shop online? You can see the latest business energy prices in just 30 seconds using our comparison tool, if you like what you see you can also complete your switch completely online!

You will have access to a wide range of energy quotes for your business electricity and gas. For large consumption businesses requiring a more bespoke tariff, we’re just at the other end of the phone.

Thousands of small and large companies across the UK have already partnered with us to reduce their business energy bills. Start saving today and compare business energy prices.

Read on to learn more about:

How To Switch Your Business Energy Supply

How To Find Accurate Business Energy Prices

Average Business Energy Prices 2024

Business Energy Rates By Region

Who Is The Cheapest Business Energy Supplier?

Energy Bill Discount Scheme For Businesses

What Types Of Business Energy Tariffs Are Available?

Small Business Energy Comparison

Large Business Energy Comparison

What Are The Latest Business Energy Prices Per kWh in 2024?

Business energy prices fluctuate depending on a variety of factors including wholesale prices, regional location and consumption.

You should compare prices today for an accurate business energy quote.

If you feel you’re overpaying for your energy, now could be the time to compare business energy prices and switch to a cheaper business energy tariff.

The figures presented are for business energy tariffs on a 2-year fixed rate contract and averaged across available suppliers for all regions in the UK.

| Business Size (Annual Usage) |

Electricity (p/kWh) | Annual Electricity Cost | Gas (p/kWh) | Annual Gas Cost |

|---|---|---|---|---|

| Very Small/Micro (up to 5,000 kWh) |

25.2p | £895.75 |

8.6p |

£351.03 |

| Small (5,000-15,000kWh) |

25.2p | £2,803.37 |

7.6p |

£931.05 |

|

Medium |

25.2p | £5,356.58 |

7.4p |

£1,660.90 |

| Large (25,000-50,000kWh) |

26p | £10,164.12 |

7.4p |

£2,993.17 |

| Extra Large/Corporate (50,000-100,000kWh) |

25.1p | £19,255.64 |

6.5p |

£5,457.85 |

Data correct as of April 2024. Annual cost based on a 2-year business energy contract and the maximum kWh usage within each business size banding. These prices reflect a live market and are subject to fluctuation.

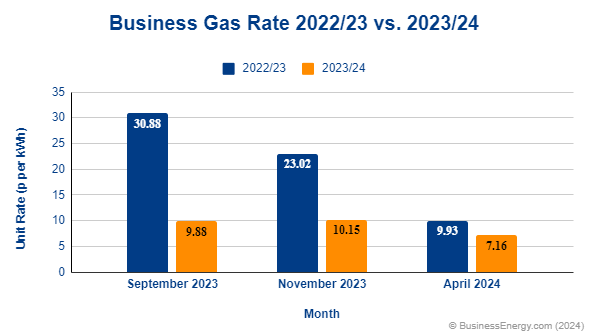

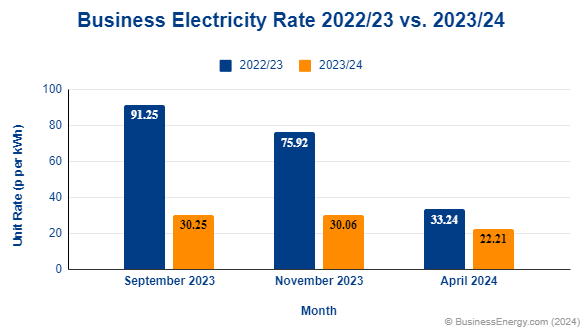

Are Business Energy Prices Still Rising?

No, business energy prices settled down a while ago and unit rates have actually been dropping for quite some time.

Energy prices have been making the headlines for all the wrong reasons in recent years, but one bit of good news is that business energy unit rates have fallen almost every month from late 2022 through early 2024.

We looked at the three most affordable tariffs and found that the average cheapest price has dropped from almost 90p per kWh in 2022 to just over 22p in April 2024.

Current Business Energy Unit Rates

Here, you can find the latest business energy rates from a range of suppliers.

It's important to keep in mind that your exact rates will depend on your business individual circumstances and these are provided as a guide.

|

Supplier |

Electricity Unit Price (p/per kWh) |

Gas Unit Price (p/ per kWh) |

|

24.9p |

6.7p |

|

|

29.4p |

7.8p |

|

|

22.9p |

N/A |

|

|

23.0p |

7.1p |

|

|

29.0p |

7.1p |

|

|

26.1p |

6.9p |

Data correct as of April 2024. Annual cost based on a 2-year contract and the maximum kWh usage within each business size banding. These prices reflect a live market and are subject to fluctuation.

How To Switch Your Business Energy Supply

You’ll need to switch each fuel separately as there are no dual fuel tariffs available for business energy contracts. However, this means you can source the cheapest provider for each fuel.

You may find it easier to have a recent business energy bill to hand, although this isn’t essential. We’ll ask for your business address and permission to look up your meter numbers. In most cases, we will be able to get your annual consumption to offer you an accurate business energy quote. You will be able to see prices within 30 seconds once you start our business energy comparison engine.

Once you’re happy with the price, We’ll aim to have you switched over to your new supplier within 5 working days.

Latest Business Energy Rates By Region

Did you know that your business energy prices will change depending on what region of the country you're based in.

The cost of supplying gas and electricity to your region can impact your overall energy bill. For example, those based in North Wales will pay a higher price per kWh on average than those based in London.

|

Region |

Electricity Unit Price (p/per kWh) |

Gas Unit Price (p/per kWh) |

|

London |

24.7p |

7.3p |

|

North East |

25.9p |

7.4p |

| North West |

26.1p |

7.3p |

| East Midlands |

25.3p |

7.3p |

| West Midlands |

25.6p |

7.2p |

| Yorkshire |

25.6p |

6.9p |

| East |

25.1p |

7.2p |

| South East |

25.4p |

7.5p |

| South West |

26.6p |

7.6p |

| South |

25.6p |

7.4p |

| Scotland |

26.4p |

7.3p |

| North Wales, Merseyside & Cheshire |

28.5p |

7.3p |

| South Wales |

26.1p |

7.4p |

Data correct as of April 2024. Annual cost based on a 2-year contract. These prices reflect a live market and are subject to fluctuation.

Energy Bill Discount Scheme For Businesses

We all love a bit of discount and as many are feeling the pinch right now, it is very welcome news.

First of all, the Energy Bill Discount Scheme (EBDS) replaces the old relief scheme. This means that discounts will be applied to business energy usage between April 2023 and March 2024.

This discount will be automatically applied to business energy unit prices only if the wholesale prices exceed a certain level. The discount will be the difference between the wholesale price for that contract type and the wholesale price threshold – subject to a maximum discount.

Business energy suppliers will apply the discount automatically to bills and you do not need to apply for the scheme. Companies can switch business energy suppliers and still receive the EBDS discount.

Maximise your savings and compare business energy prices today. Companies can still switch business energy provider and make use of the discount until 2024. Our prices do not include the discount, but if you’re eligible it will be automatically applied by your new supplier.

Normal Businesses (not Energy and Trade Intensive Industries)

|

Fuel Type |

Wholesale Price Threshold* |

Maximum Discount* |

|

Electric |

30.2p/kWh |

1.961p/kWh |

|

Gas |

10.7p/kWh |

0.697p/kWh |

Energy and Trade Intensive Industries

|

Fuel Type |

Wholesale Price Threshold* |

Maximum Discount* |

|

Electric |

18.5p/kWh |

8.9p/kWh |

|

Gas |

9.9p/kWh |

4p/kWh |

When Is The Best Time To Renew My Business Energy Contracts?

As your business energy contracts come to an end, you should receive a letter between 60 - 90 days stipulating the exact end date and whether you’d be looking to renew with your current supplier. Before agreeing to continue with the same supplier, we always recommend shopping around for a better deal, to save you and your business some money that could be invested elsewhere in the company.

If you don’t renew your contract with your current supplier or fail to switch to a better deal with someone new, you could be rolled onto a deemed tariff which is usually much more inflated and expensive. So, the best time to renew your business energy contracts is within your renewal window, to guarantee you don’t end up paying more than you should.

When you renew with BusinessEnergy.com you will be taken care of by our elite team of energy experts. They will handle all communications with your chosen supplier and will always negotiate a better deal for you. Our energy experts will also be able to find you the best deals when it comes back round to renewing again as your next contract ends, leaving you to run your business. We will take care of the energy side, and communicate with you on any updates.

How To Find Accurate Business Energy Prices & Get The Cheapest Quote

Finding the cheapest business energy quote is about having access to the most accurate information. Most of this will be on recent energy bills. A great starting point to getting a cheaper deal is to consider how your business uses energy.

Consider the following questions:

- How much energy do I use annually?

- How much is my business energy bill each month?

- What time of day or night do I use the most energy?

- Do I have multiple premises?

- Do I want to fix my prices for more security?

- Do I like my current provider?

- Do I have a smart meter?

These questions can help shape your business energy quote and ensure you’re getting the cheapest price possible for your business in our comparison engine. For example, your business may have access to more ‘buying power’ if you opt for a multi-site meter that combines billing of multiple buildings rather than having separate contracts.

As an impartial business energy retailer, we’ve helped companies of all shapes and sizes reduce their annual business energy costs by £1,067* on average.

-

Variable Tariffs

This is a flexible tariff and your unit price will change each month. Whilst this may be great for more flexibility, it does mean that there's a risk of paying higher rates if wholesale prices increase. However, this works the other way too if prices decrease. This tariff largely depends on a businesses attitude to risk.

-

Fixed Tariffs

A fixed tariff is the most popular choice. This fixes the unit price for the duration of the contract regardless of what wholesale prices do. This means if wholesale prices start to increase, yours won't as you have your fixed tariff protection. This is great for businesses who would like some security and predictability when it comes to budgeting.

-

Deemed Rate Tariffs

Business energy suppliers will place you on a deemed rate tariff if no contract has been agreed previously. Typically, businesses who have just moved into a new premises may find themselves on this tariff. These business energy rates are usually the most expensive and should be avoided.

-

Out Of Contract Rates

If you have not agreed to a new business energy deal before your current contract end date, you will be placed on out of contract rates. These are some of the most expensive unit rate that suppliers offers.

-

Green Energy Tariffs

A green energy tariff is a type of energy contract where your supplier matches the energy you buy with purchases of renewable energy. These tariffs are a great way to start the journey of reducing your business’s carbon emissions.

Small Business Energy Comparison

We understand how busy running a small business can get. This may mean that tasks like comparing business energy suppliers may often get pushed down the priority list. To eliminate these barriers, we have created a comparison engine that allows our customers to compare business energy prices, select a new tariff and switch completely online, whether your find a couple of minutes during the day or night.

Should you need further assistance with your tariff or require a new energy meter, we're only a phone call away.

Large Business Energy Comparison

We have a team of large consumption specialists that will build a bespoke business energy tariff based on specific requirements. With everything from multiple premises to half-hourly meters considered, we’ll take care of everything.

Business Energy FAQs

-

Do We Offer Dual Fuel Tariffs?

Business energy suppliers do not offer dual fuel tariffs. You will need to switch your business electricity and gas contracts separately.

They can be easily managed if you switch both of them at the same time for the same contract length. This allows you to keep track of the contract end date.

-

What is the Climate Change Levy (CCL)?

The Climate Change Levy is an environmental tax paid by businesses on the energy they use. These rates will be applied to your bill automatically by your energy supplier.

Here are the Climate Change Levy rates until April 2024:

- Electricity (per kWh): 0.775p

- Gas (per kWh): 0.672p

Data source: https://www.gov.uk/guidance/climate-change-levy-rates

-

What Is A Half-Hourly Meter?

Half-hourly meters are mandatory for large consumption businesses with a maximum demand of 100 kWh of electricity or 70,000 kWh of gas or greater in a 30-minute period.

These meters submit energy readings to your supplier every 30 minutes to ensure you’re not billed based on estimated usage.

-

How Long Does It Take To Switch Business Energy?

We aim to switch our customers to their new supplier within 5 working days of approval.

-

How Can My Business Avoid a Rollover Contract?

Setting a reminder in your calendar is enough in most cases. Energy companies are obligated to inform you, within 60 days of when your contract is coming to an end. This provides you with plenty of time to switch.

Each business energy contract has a termination period during which time you can switch to a new tariff. This varies depending on the supplier. You can get this information by contacting your business energy supplier.

If you switch with Business Energy, we take on all the admin for you. This means that you will avoid rollover contracts and avoid the street of staying on top of your energy. We will find you the best deal and let you know if a better deal comes along. Your dedicated account manager will be in touch when your contract is up for renewal.

-

How Does My Business Set Up Gas and Electricity for the First Time?

The first step when moving premises is to check you’re connected to both gas and electricity meters. If you don’t have a connection, you will most likely be required to pay a connection fee. It is worth knowing prior to moving in, as getting connected can take time.

Your gas and electricity will be provided by the same energy supplier that the previous tenant or owner used. Make sure you check that there is no outstanding debt on the premises, as this can lead to the property being disconnected.

For gas supply – go to the Meter Point Administration Service. You will need your meter point number (see below) or request it if you’re unsure.

For electricity supply – contact your local distribution network. You will need your meter point number (see below)

Business Energy recommends you set up a new commercial energy contract before moving in. You can do this once you have your tenancy agreement. This also reduces the likelihood you will face any unforeseen surprises once you move in.

If you move in and start using energy without an existing contract, you will be on a deemed contract with the existing supplier. This is a very expensive tariff so should be avoided if possible.

-

Does My Company Have to Pay VAT on Its Business Energy?

Standard VAT on commercial electricity and business gas bills applies if annual turnover is more than £85,000.

If your business falls into this category you need to register for VAT with HMRC. Once you have applied, you will receive a VAT registration certificate.

Energy suppliers will charge VAT at a standard rate. So if you are eligible for the discounted rate, you will need to inform them to alter your bills.

Your business will qualify for a 5% discounted rate if any of the following apply:

- Your company’s gas usage is less than 4,397 kWh per month, and business electricity usage is 1000 kWh per month;

- You run a charity or non-profit;

- 60% or more of the energy used by your company is for domestic purposes.

You need to contact your energy supplier if any of the above apply to qualify for the 5% rate.

-

Should I Carry Out a Business Energy Audit?

All businesses should complete a business energy audit. They can have a huge impact on large businesses, but smaller business will see savings from this too.

A business energy audit will expose any wasted energy. Taking the time to consider where energy is being spent provides a base plan to become more efficient.

It will only take a couple of hours to complete a business energy audit. Here's what you do:

- Determine How Much Energy Your Business Is Using.

- Identify areas for improvement.

- Agree which areas need to be tackled first.

- Review your business energy contract.

-

What’s The Difference Between Long-Term And Short-Term Business Energy Contracts?

Short-term business energy contracts are like renting - they are much more flexible but prices can change quickly. Long-term contracts are like buying - stable, but you are committed even if prices drop or rise.

Short-Term Energy Contracts

Pro: Flexible

Con: Price Volatility

Long-Term Energy Contracts

Pro: Stability

Con: Less Flexibility

Choosing the right energy contract length depends on your business energy needs and risk tolerance, like energy consumption and budget.